Fleet truck insurance is a specialized solution for businesses with multiple trucks, offering comprehensive protection against unique risks. It includes tailored liability, physical damage, and diverse coverage options for all types of fleets. Effective fleet risk management involves assessing individual truck usage and customizing policies to safeguard vehicles, drivers, and businesses from financial losses, legal liabilities, and operational disruptions. By integrating robust fleet insurance strategies, companies can ensure the longevity and prosperity of their commercial fleets in today's dynamic landscape.

“In the world of commercial transportation, a robust fleet truck insurance solution is not just an option—it’s a necessity. This comprehensive guide, ‘Understanding Fleet Truck Insurance: A Comprehensive Guide,’ delves into the intricacies of protecting your valuable fleet vehicles and drivers. From key components of a fleet insurance policy to managing risk and exploring multiple truck coverage options, we empower business owners with knowledge. Discover how effective fleet risk management ensures your commercial fleet’s long-term success and financial security.”

- Understanding Fleet Truck Insurance: A Comprehensive Guide

- Key Components of a Fleet Insurance Policy

- Managing Risk and Ensuring Protection for Your Commercial Fleet

- Benefits and Types of Multiple Truck Coverage

Understanding Fleet Truck Insurance: A Comprehensive Guide

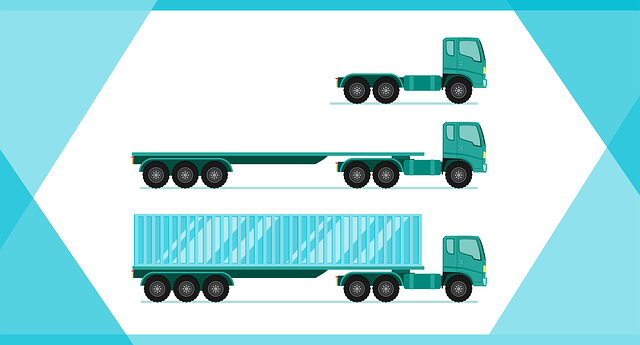

Fleet truck insurance is a specialized coverage designed to meet the unique needs of businesses owning and operating multiple trucks or vehicles in their fleet. It’s not just about insuring individual trucks; it involves comprehensive risk management for the entire fleet, ensuring protection against diverse potential risks and liabilities. This type of insurance policy considers the specific operations, drivers, and usage patterns of each truck within the fleet, offering tailored solutions to mitigate financial losses.

A fleet insurance policy typically covers a wide range of perils, including accidents, natural disasters, theft, vandalism, and mechanical failures. It provides liability coverage to protect against claims arising from injuries or property damage caused by your trucks. Moreover, it offers comprehensive vehicle protection for all fleet vehicles, ensuring business continuity in the face of unforeseen events. Effective fleet risk management involves assessing each truck’s usage, understanding potential hazards specific to the industry, and customizing insurance plans to align with these insights, thereby delivering optimal truck fleet protection for businesses operating large or small commercial fleets.

Key Components of a Fleet Insurance Policy

When choosing a fleet truck insurance solution, several key components ensure comprehensive protection for your business and its vehicles. A robust fleet insurance policy typically includes liability coverage, which protects against claims arising from accidents involving your trucks. This is essential in managing fleet risk, as it can shield your company from significant financial losses. Additionally, physical damage coverage safeguards your vehicles from perils like collisions, natural disasters, or vandalism, offering peace of mind and truck fleet protection.

Multiple truck coverage is another critical aspect, catering to the diverse needs of businesses with extensive fleets. This ensures that each vehicle receives adequate insurance, whether it’s for a single truck or an entire commercial fleet. Fleet vehicle insurance policies also often incorporate provisions for rental reimbursement and legal expenses, providing extra layers of security. These comprehensive solutions enable efficient fleet risk management by addressing various risks associated with owning and operating a fleet of trucks.

Managing Risk and Ensuring Protection for Your Commercial Fleet

Managing Risk and Ensuring Protection for Your Commercial Fleet

In the dynamic world of trucking, managing risk is paramount to maintaining a successful and safe operation. A comprehensive fleet truck insurance solution isn’t just about minimizing financial exposure; it’s about safeguarding your business from unforeseen events that can disrupt your operations. Fleet insurance policies designed for multiple trucks offer tailored coverage for each vehicle in your fleet, addressing specific risks like liability, collision, and cargo damage. This multi-faceted approach ensures that no single incident can cripple your entire operation.

Effective fleet risk management involves more than just insuring against physical damages. It encompasses protecting your business from legal liabilities arising from accidents or incidents involving your trucks. Fleet liability insurance plays a crucial role in this, providing financial backing for legal fees, medical expenses, and other costs associated with claims against your company. By integrating such robust protection into your fleet management strategy, you can foster a culture of safety and accountability, ensuring the longevity and prosperity of your commercial fleet.

Benefits and Types of Multiple Truck Coverage

Having comprehensive fleet truck insurance is essential for businesses operating a fleet of trucks to ensure fleet risk management. It provides multiple layers of protection tailored to the unique needs of commercial fleets, addressing various risks associated with trucking operations. This coverage goes beyond standard vehicle insurance, offering specialized options for businesses to mitigate their exposure to financial loss.

There are several types of multiple truck coverage available, each catering to distinct aspects of fleet management. Fleet liability insurance protects against claims arising from accidents or damage caused by the trucks, ensuring business owners are covered legally. On the other hand, fleet vehicle insurance provides comprehensive protection for the physical vehicles, including repairs and replacement in case of theft or damage. Additionally, some policies include fleet truck protection for specialized equipment and cargo, offering extra security during transportation. These diverse coverage options allow businesses to create a customized fleet insurance policy aligned with their specific operations and risk profiles, ultimately streamlining their fleet risk management strategies.

Complete fleet truck insurance solutions are essential for businesses operating a commercial fleet to manage risk and ensure protection. By understanding the key components of a fleet insurance policy and the benefits of multiple truck coverage, you can navigate the complex landscape of fleet risk management. In today’s digital era, choosing the right fleet vehicle insurance means prioritizing safety, compliance, and peace of mind. Embrace a comprehensive fleet insurance approach to safeguard your assets, protect your business, and foster sustainable growth.